kathyl38632301

About kathyl38632301

Understanding Personal Loans For Bad Credit: A Complete Case Examine

Introduction

Personal loans are a financial instrument that will help people meet numerous wants, akin to consolidating debt, financing dwelling improvements, or protecting unexpected bills. However, for those with dangerous credit score, accessing these loans may be difficult. This case research explores the intricacies of personal loans for individuals with poor credit scores, highlighting the experiences of a fictional character, Sarah, who navigates this monetary landscape.

Background

Sarah, a 32-yr-old single mom, has been struggling along with her finances since losing her job in the course of the pandemic. Though she has since discovered employment, her credit rating has taken successful because of missed payments and high bank card balances. With a credit score rating of 580, Sarah falls into the ”dangerous credit score” category, which considerably limits her borrowing options. She needs a personal loan of $10,000 to consolidate her high-curiosity credit card debt and manage her month-to-month bills higher.

Understanding Dangerous Credit score

Bad credit is usually outlined as a credit score under 600. It will probably result from numerous components, together with late funds, defaults, excessive credit score utilization, and bankruptcy. People with unhealthy credit typically face higher interest charges, stringent repayment phrases, and limited loan options. In Sarah’s case, her low credit score makes her a riskier borrower within the eyes of lenders, which complicates her search for a personal loan.

Researching Loan Options

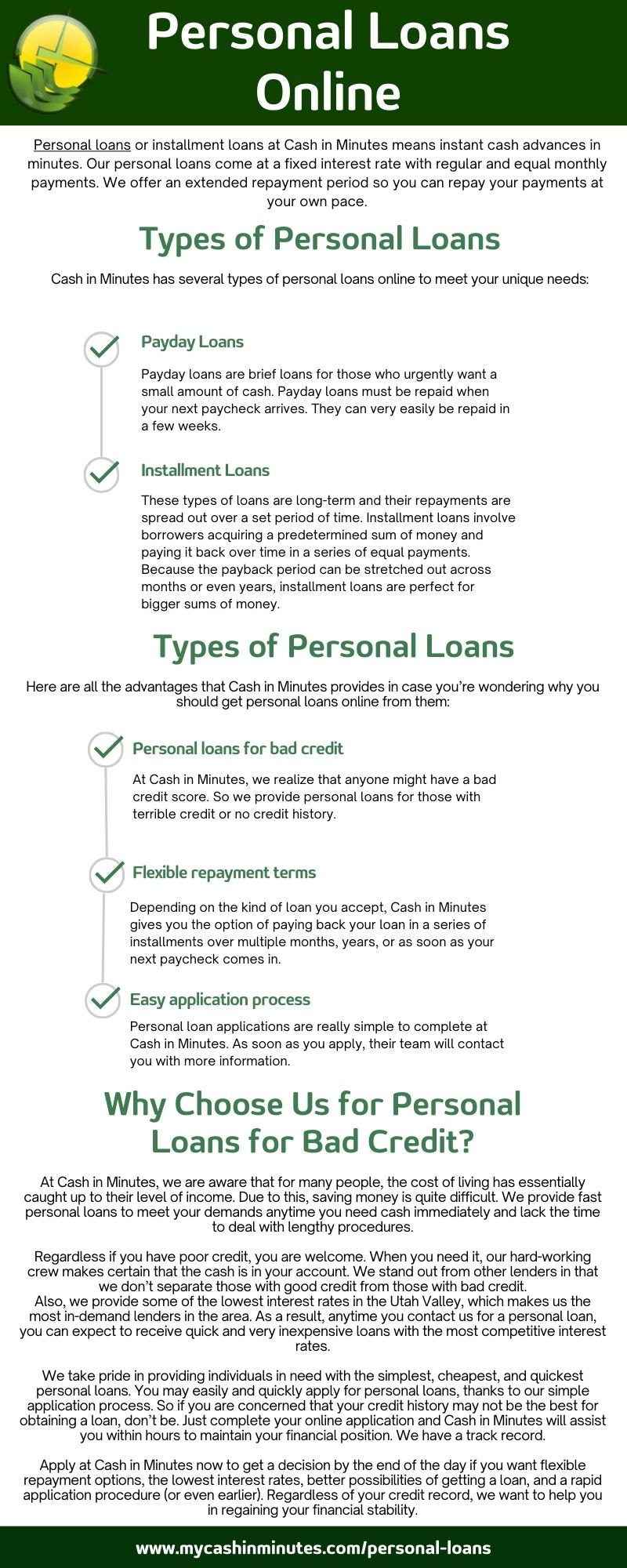

Sarah begins her journey by researching potential lenders. She rapidly discovers that traditional banks and credit unions are much less more likely to approve her utility due to her credit history. As an alternative, she turns her consideration to different lenders, together with online personal loan suppliers that cater particularly to people with unhealthy credit.

Exploring Different Lenders

Sarah finds a number of online lenders that advertise personal loans for bad credit. She fastidiously opinions each lender’s terms, interest charges, and fees. Some key gamers on this house embody:

- Avant: Offers personal loans with versatile terms for those with credit scores as low as 580. Interest rates vary from 9.95% to 35.99%.

- OneMain Monetary: Offers secured and unsecured loans, making it a viable possibility for individuals with unhealthy credit score. Loan amounts vary from $1,500 to $20,000.

- Upstart: Makes use of different data to assess creditworthiness, permitting borrowers with decrease credit score scores to qualify. Curiosity charges start at 8.8%.

After evaluating these options, Sarah decides to apply for a loan with Avant, as they provide an inexpensive interest rate and a fast software course of.

The application Process

Sarah fills out the net software, offering her personal data, income particulars, and employment historical past. She is upfront about her credit score situation, realizing that transparency is essential. Inside minutes, she receives a conditional approval, pending additional verification of her data.

The lender requests documentation, together with pay stubs and bank statements, to verify her income and ability to repay the loan. After submitting the required paperwork, Sarah anxiously awaits the final determination.

Approval and Phrases

A number of days later, Sarah receives an e mail confirming her loan approval for $10,000 at an curiosity fee of 24. If you have any sort of concerns regarding where and how you can make use of $3000 personal loan bad credit, you could call us at our own internet site. 99% with a repayment term of five years. Whereas the interest rate is increased than what she would have received with higher credit score, Sarah is relieved to have secured the funding she wants. She critiques the loan settlement carefully, noting the month-to-month payments and total repayment amount.

Managing Loan Repayment

With the loan funds disbursed, Sarah uses the money to repay her excessive-curiosity credit playing cards, consolidating her debt right into a single month-to-month payment. This move not only simplifies her finances but in addition reduces her total curiosity prices.

To ensure timely repayments, Sarah creates a budget that prioritizes her loan fee. She units up computerized payments to keep away from any late charges, recognizing the significance of sustaining a constructive payment historical past going ahead.

Building Higher Credit

As Sarah makes consistent payments on her new loan, she begins to see an improvement in her credit rating. Each on-time payment positively impacts her credit score history, demonstrating her dedication to responsible borrowing. Over the next 12 months, she monitors her credit report and takes further steps to enhance her credit score profile, equivalent to decreasing her bank card balances and avoiding new debt.

Lessons Realized

Via her journey, Sarah learns several priceless classes about personal loans and managing unhealthy credit:

- Research is Crucial: Understanding the loan market and comparing options may help borrowers discover the most effective terms obtainable, even with bad credit score.

- Transparency Issues: Being sincere about her financial situation allowed Sarah to secure a loan despite her credit challenges.

- Budgeting is vital: Making a budget and sticking to it is essential for managing loan repayments and avoiding future debt.

- Credit Improvement Takes Time: Building credit score is a gradual course of that requires consistent effort and accountable monetary conduct.

Conclusion

Sarah’s expertise illustrates the challenges and opportunities related to personal loans for individuals with bad credit score. Whereas securing a loan could also be more difficult for these with low credit scores, various lenders present viable options. By understanding the terms, managing repayments effectively, and taking steps to enhance her credit score, Sarah is on a path toward monetary restoration. This case examine serves as a reminder that whereas bad credit score can pose obstacles, it’s not insurmountable, and with the appropriate method, individuals can regain control of their monetary futures.

No listing found.